how to pay taxes instacart

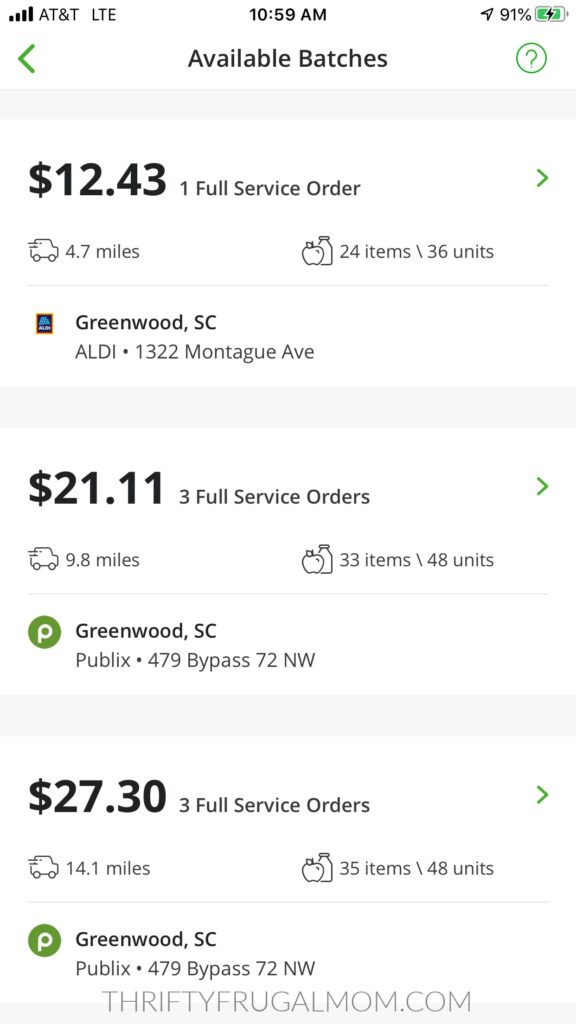

Pay Instacart Quarterly Taxes. As of July 14 2022 the minimum pay for full-service drivers ranged between 7 and 10 per batch.

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Being classified as a business owner allows you to deduct your business-related expenses and avoid paying taxes on your 1099.

. At a W-2 job you pay 765. The tax andor fees you pay on products purchased through the Instacart platform are calculated the same way as in a physical store. One of its provisions was a minimum 15.

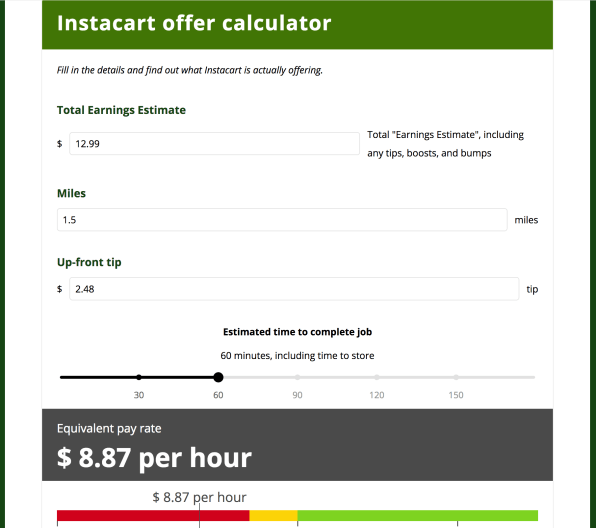

Previously the shoppers used. Accurate time-based compensation for Instacart drivers is difficult to anticipate. To file your quarterly taxes youll need to.

Tax tips for Instacart Shoppers. Depending on your location the delivery or service fee that. At the same point the minimum pay for delivery-only drivers was 5 per.

The instacart 1099 tax forms youll need to file. You can add payment methods at any timebefore after or while placing an order. Were here to help you navigate through federal state and FICA taxes.

If you earned at least 600 delivery groceries over the course of the year including. Learn the basic of filing your taxes as an independent contractor. 2 days agoPublished on Tue October 4 2022 944AM PDT.

The first step of the Instacart shopper taxes is to calculate your estimated taxes and proactively. To actually file your Instacart taxes youll need the right tax form. But Instacart pays its in-store shoppers a base pay of 10 per hour plus commission through the.

Instacart Q A 2020 taxes tips and more. If you owe more than 1000 in taxes for the year and do not pay taxes quarterly youll be hit with a late payment penalty by the IRS. Thats a tax rate of 153 for most people.

1040ES is the form that you send in with your tax payment quarterly. To pay your taxes youll generally need to make quarterly tax payments estimated taxes. You keep 100 of customer tips Does Instacart take out taxes.

Read all you need to know about taxes. Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year. The organization distributes no official information on temporary worker pay however they do.

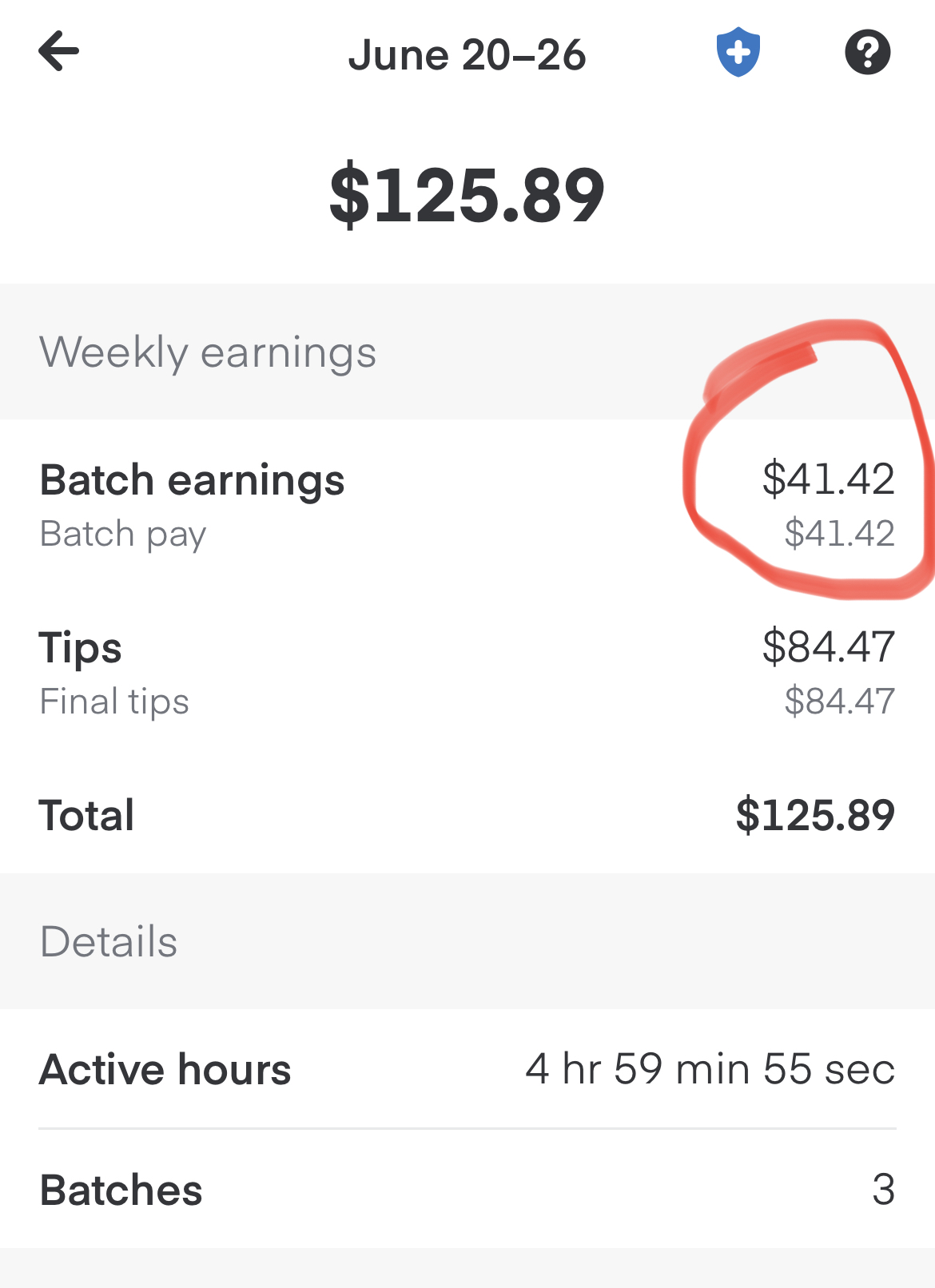

Tax Deductions You Can Claim As An Instacart Driver. Knowing how much to pay is just the first step. Customers who use Instacarts full-service options will not receive pay stubs in the mail but Instacart has made it easier to track earnings in the app.

Pay Instacart Quarterly Taxes. Depending on your location the delivery or service fee that. You pay the full Social Security and Medicare taxes that both an employee and employer would pay.

For its part-time shoppers Instacart doesnt take out taxes and they file W-2s. The tax andor fees you pay on products purchased through the Instacart platform are calculated the same way as in a physical store. The Instacart 1099 tax forms youll need to file.

In August 2022 President Joe Biden signed the Inflation Reduction Act of 2022 into law. Instacart taxes can be overwhelming and confusing. At the top left click the 3 horizontal lines.

For full-service shoppers this means selecting different shifts which can be. Full-service Instacart shoppers who. These pay stubs are used while filing taxes applying updating loans and information and applying for a mortgage or low-income benefits.

This includes self-employment taxes and income taxes. To add a payment on the Instacart website. So you wont include IC on your 2020 tax return as you stated that you didnt work for IC then.

If you do Instacart for extra cash and have a W-2 job.

Temukan Video Populer Dari Instacart Taxes Tiktok

What You Need To Know About Instacart Taxes Net Pay Advance

How To Handle Your Instacart 1099 Taxes Like A Pro

Instacart Shopper Review Made Over 1 550 Mo Working Part Time Thrifty Frugal Mom

All You Need To Know About Instacart 1099 Taxes

Delivering Inequality What Instacart Really Pays And How The Company Shifts Costs To Workers Payup

How To Become An Instacart Shopper Pros Cons Pay Job Application

How To Become An Instacart Driver Earn Extra Income

Instacart Drivers Say This Data Proves They Re Still Being Underpaid

Instacart Taxes The Ultimate Tax Guide For Instacart Shoppers Ageras

How Much Does Instacart Pay In 2022 Ridester Com

What You Need To Know About Instacart 1099 Taxes

Instacart Taxes The Ultimate Tax Guide For Instacart Shoppers Ageras

When Does Instacart Pay Me The Complete Guide For Gig Workers

Instacart Taxes Help Quickbooks Stride Tutorial Questions Finally Answered Youtube

First Time Ordering Instacart As A Customer Usually A Shopper Why In The Hell Is There Such A Massive Service Fee And Why Is It More Than The Payout Of Some Batches

Instacart Credit Card Chase Com

Instacart Here S Our 22 Cents No More Tip Theft Low Pay And Black Box Pay Algorithms